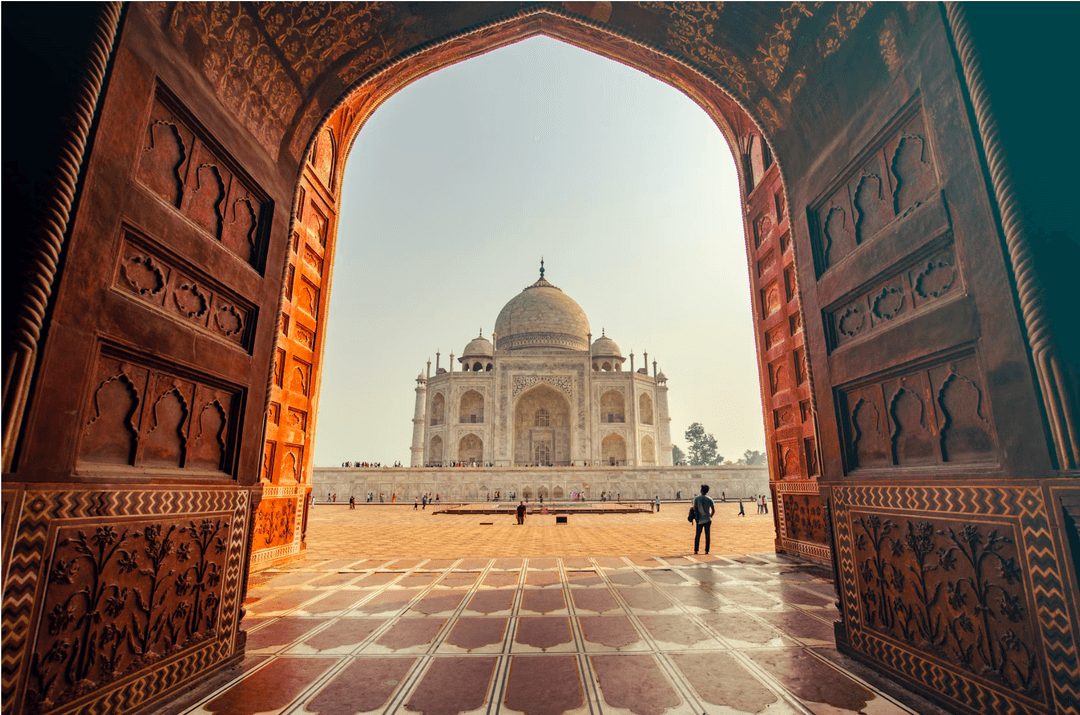

India is one of the world’s most fascinating destinations, attracting millions of international visitors each year with its ancient culture, magnificent heritage, and unique spiritual experiences. Whether you travel to India for leisure or business, everyone hopes for a smooth and safe journey. One of the key factors for a complete trip is travel insurance.

However, many travelers still wonder: Is travel insurance mandatory for visiting India? If yes, what are the specific conditions? This article will help you understand India’s current policies on travel insurance and suggest the benefits you should consider before departure.

1. Is travel insurance mandatory for international tourists in India?

According to current laws, India does not require international visitors to have travel insurance upon entry. In other words, whether you travel on an e-Tourist Visa or an e-Business Visa, purchasing travel insurance is recommended but not a legal obligation.

This differs from some European countries, where travel health insurance is mandatory for a Schengen visa. In India, the government aims to provide maximum convenience to travelers without imposing additional insurance requirements.

That said, risks can occur: sudden illness, road accidents, lost luggage, or itinerary disruptions due to natural disasters. While no one expects such events, the costs can be significant. That is why travel experts, regulatory agencies, and even the Indian insurance industry strongly recommend travelers purchase suitable coverage.

2. Legal framework for travel insurance in India

Although not compulsory, travel insurance in India falls under regulatory oversight. All insurance products are governed by the Insurance Act and sector-specific regulations.

Notably:

-

Since January 1, 2023, KYC (Know Your Customer) verification has been mandatory for all insurance policies, including travel insurance. When purchasing or renewing a policy, customers must provide identity documents to ensure transparency and prevent money laundering.

-

This demonstrates the Indian government’s efforts to protect consumer rights and make the insurance sector more professional.

3. Supervising authority: IRDAI

The entire insurance sector in India is regulated by the Insurance Regulatory and Development Authority of India (IRDAI), established in 1999. Its mission includes:

-

Protecting policyholders’ interests.

-

Licensing and regulating insurance companies.

-

Issuing guidelines to ensure market stability and transparency.

For example, in 2021, IRDAI introduced a standardized domestic travel insurance product called “Bharat Yatra Suraksha”, which every insurer is required to offer under uniform terms. This highlights IRDAI’s commitment to consumer protection.

For international visitors, while travel insurance is not mandatory, IRDAI’s presence ensures that if you purchase a policy in India, your rights will be safeguarded under a clear legal framework.

4. Key benefits of travel insurance

For a safe trip to India, travelers should consider policies with the following coverage:

4.1. Medical and accident coverage

This is the most crucial component. Healthcare costs in India can be expensive for foreigners, especially in emergencies or surgeries. Travel insurance covers hospitalization, medication, and medical evacuation, including repatriation in serious cases.

4.2. Baggage and personal belongings insurance

If luggage is lost, damaged, or important documents (such as your passport) are misplaced, insurance can cover replacement costs and necessary procedures.

4.3. Trip cancellation or delay insurance

Trips may be canceled due to sudden illness, natural disasters, or unforeseen events. Insurance reimburses prepaid expenses like flights, hotels, and tours, saving you from financial loss.

4.4. Personal liability coverage

Some plans also cover third-party liability if you accidentally cause harm to others or damage property. This is especially useful for business travelers or those attending international events.

Combining Travel Insurance with e-Visa for a Perfect Journey

While travel insurance is your safety net, the first step is obtaining a valid visa. Fortunately, applying for an India e-Visa (tourist or business) is now simple and fast.

Through the official online system at India-immi.org, you can complete your application in just a few steps without waiting in consulates. This is the ideal solution for saving time and ensuring accuracy.

Conclusion

Although India does not legally require travel insurance for international visitors, having comprehensive coverage is always a wise choice. It protects your health, belongings, and itinerary while giving you peace of mind to fully enjoy India’s vibrant culture.

At the same time, don’t forget to secure your India e-Visa before departure. Let India-immi.org assist you with the first important step.

👉 Apply for your India e-Visa today at India-immi.org to start your journey safely and smoothly!