India - the land of ancient culture, magnificent architectural heritage, and a vibrant economy - has always been an attractive destination for travelers from all over the world. When visiting this vast South Asian country, besides preparing your visa and travel itinerary, it’s essential to understand the currency system and payment methods. This will help make your trip more convenient and prevent awkward situations when shopping or spending money.

The article below provides complete and updated information about the Indian rupee, how to use cash, and important notes on payment in India today.

Indian Rupee - The Official Currency

The official currency of India is the Indian Rupee (symbol: ₹, ISO code: INR). One rupee is divided into 100 paise (coins). The unique “₹” symbol is designed based on the Devanagari letter “ra” and the Latin letter “R,” with two horizontal lines at the top representing a connection to the Indian national flag.

Currency unit - Indian Rupee, source: Internet

The Reserve Bank of India (RBI) is the only authority with the right to issue banknotes from the denomination of ₹2 and above, while the ₹1 note is specially issued by the Ministry of Finance of India but is still considered legal tender. Coins are minted by the Government of India and supplied to the RBI for circulation. In addition to issuing money, the RBI manages circulation quality, withdraws and replaces old notes, and ensures the stability of the monetary system.

Banknote Denominations in Circulation

Currently, India issues the Mahatma Gandhi (New) Series featuring modern designs, vibrant colors, and cultural heritage imagery. Common denominations include: ₹10, ₹20, ₹50, ₹100, ₹200, and ₹500.

-

₹10 – Earthy brown color, featuring the Sun Temple of Konark (Odisha). This denomination is very common for small transactions.

Source: Reserve Bank of India

-

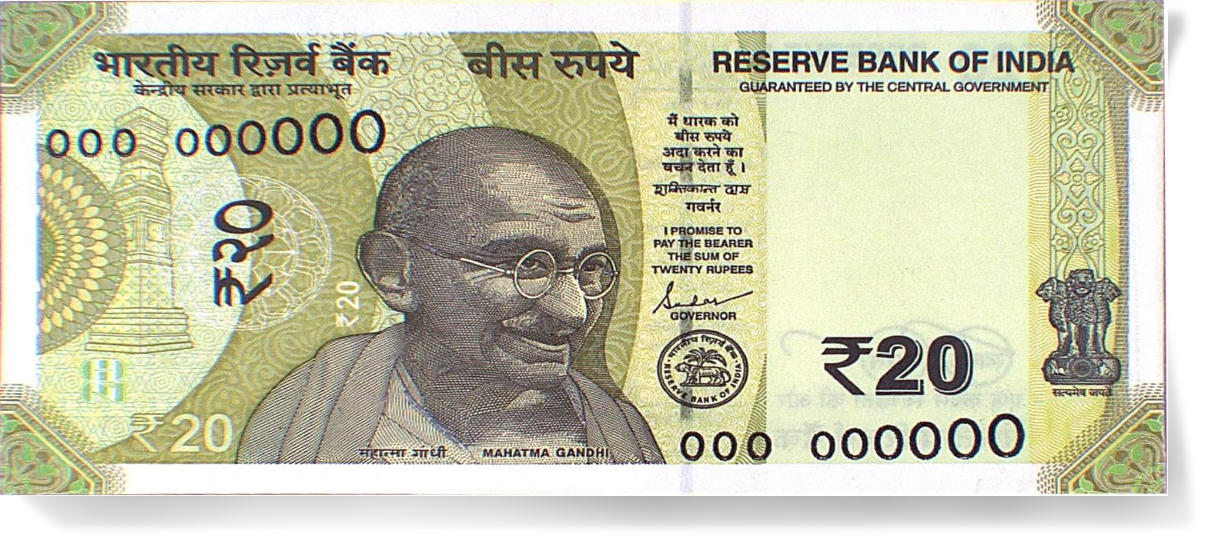

₹20 – Light greenish yellow color, reverse side depicts the Ellora Caves (Maharashtra).

Source: Reserve Bank of India

-

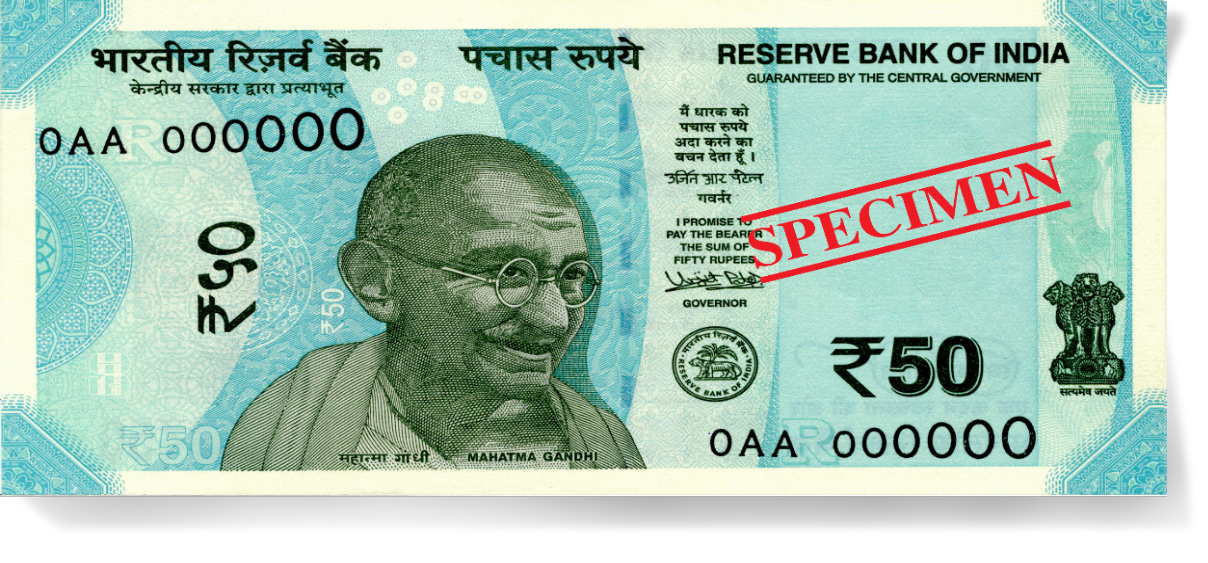

₹50 – Fluorescent blue color, features the Stone Chariot at Hampi (Karnataka).

Source: Reserve Bank of India

-

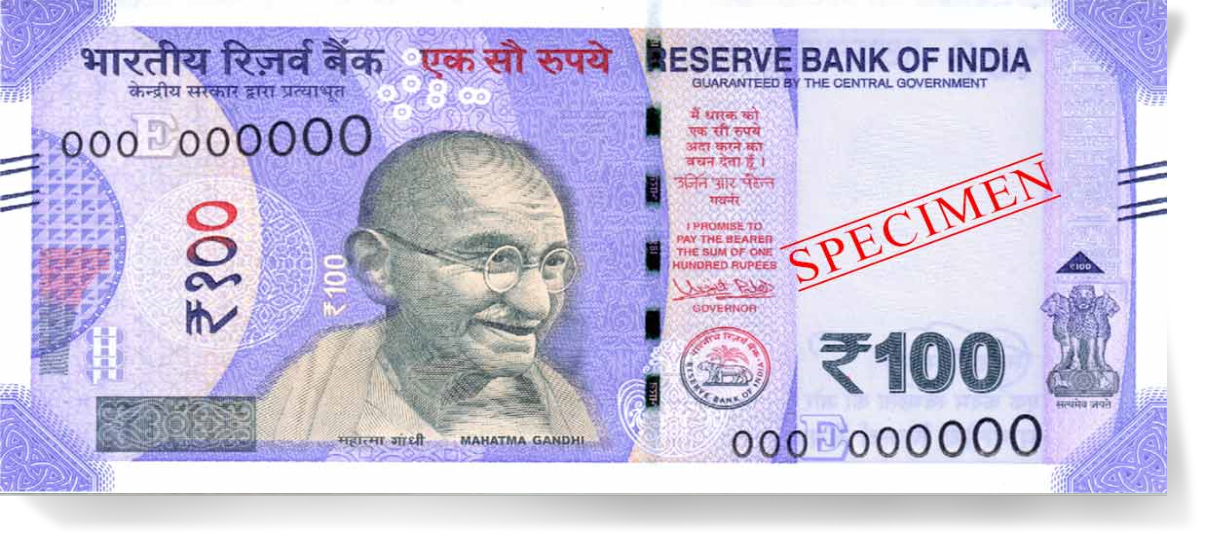

₹100 – Lavender purple color, depicting the Rani ki Vav Stepwell (Gujarat); widely available in ATMs and everyday transactions.

Source: Reserve Bank of India

-

₹200 – Bright yellow color, reverse shows the Sanchi Stupa (Madhya Pradesh).

Source: Reserve Bank of India

-

₹500 – Stone gray color, featuring the Red Fort in Delhi - the most commonly used denomination for high-value transactions.

Source: Reserve Bank of India

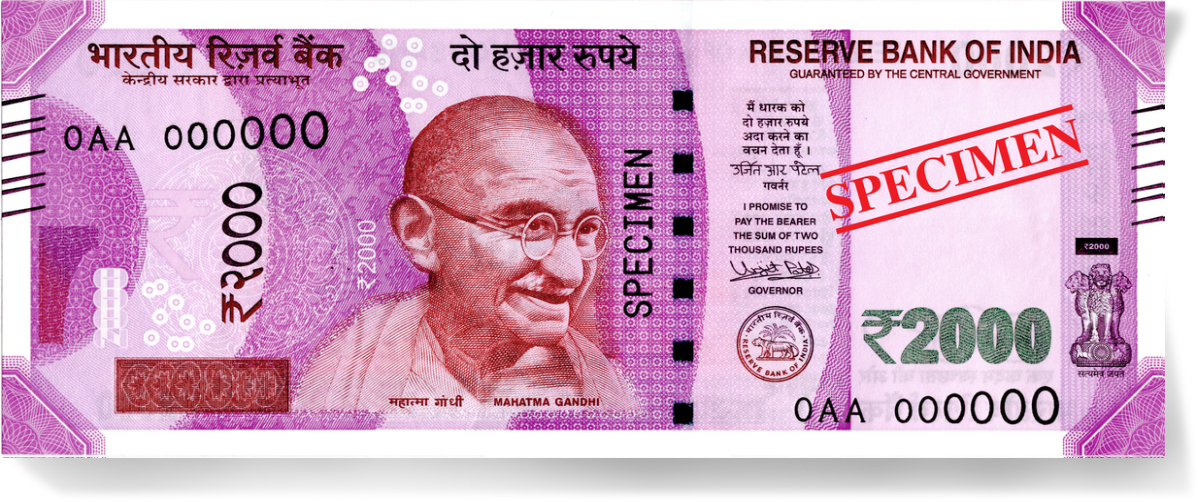

Additionally, there used to be the ₹2000 note (pink-purple, featuring the Mangalyaan Mars Orbiter), but the RBI stopped printing and began gradually withdrawing it in 2023. Travelers who receive this note should exchange it at a bank or spend it where accepted to avoid payment issues, as many small shops refuse it.

Source: Reserve Bank of India

Practical tips:

-

Carry plenty of ₹100, ₹200, and some ₹500 notes for convenient payments.

-

Many street vendors, taxis, and small shops may not have change for large denominations.

-

₹10 and ₹20 notes are very handy for public transport or small purchases.

Indian Coins and How to Recognize Them

Coins currently in circulation in India include: 50 paise, ₹1, ₹2, ₹5, ₹10, and ₹20.

-

50 paise (0.5 rupee): Very low value and rarely used in practice, though still legal tender.

Source: Internet

-

₹1 – ₹5: The most common coins, widely used for giving change.

Source: Internet

-

₹10: Bi-metallic coin (golden ring with silver center) with various designs; sometimes mistaken as “fake money,” but the RBI confirms all designs are legal tender.

Source: Internet

-

₹20: Newly issued since 2019, bi-metallic in gold and silver; limited circulation but may appear in modern transactions.

Source: Internet

Tips for International Travelers

-

Prepare small change: Helps avoid awkward situations when buying street food, using public transport, or paying taxis.

-

Always check the money you receive: Especially when exchanging at small counters or traditional markets.

-

Limit carrying large amounts of cash: Use cards or digital wallets in major cities whenever possible.

-

Monitor exchange rates: The Indian rupee is relatively stable but may fluctuate slightly. Exchange when rates are favorable.

Conclusion

Understanding the Indian rupee, how to use cash, and available payment methods will help you spend confidently and enjoy your trip without hassle. However, before exploring the land of the Taj Mahal, the first crucial step is to prepare a valid entry visa.

If you’re looking for a fast, reliable, and comprehensive Indian e-Visa service, visit India-immi.org. Our professional team will help you complete the online procedure quickly, save time, and ensure your application is smoothly approved.

Start your journey to discover India today - apply for your e-Visa easily at India-immi.org!